does betterment provide tax documents

As one of the first financial groups to. Betterment is a clear leader among robo-advisors offering two service options.

How To Start Investing With Betterment Investing Start Investing Robo Advisors

Betterment has multiple pricing plans from fee-free plans to 04 annual fees.

. Note that we do not currently support integration with. Some other investment accounts offer direct indexing or stock-level tax loss harvesting. Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals.

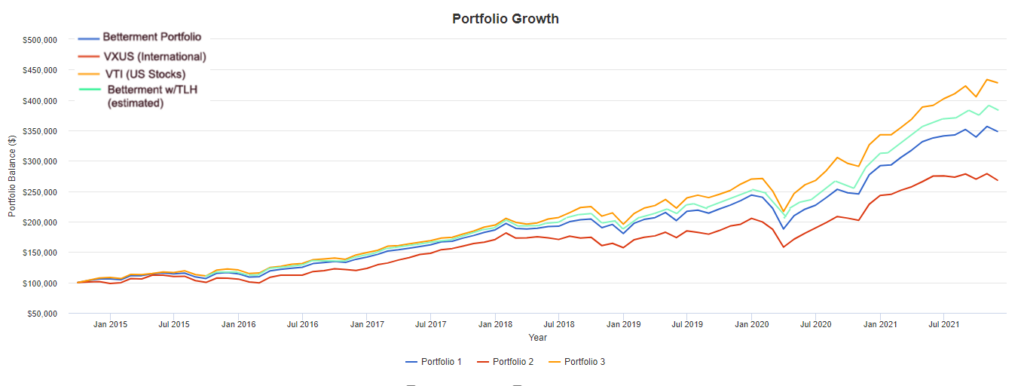

This is typically only for accounts with 500000 or more. On the other hand Betterments returns have been massive over 100 since the companys founding in 2004 so maybe they are onto something. Please note that Betterment is not a tax advisorplease consult a tax professional for additional guidance including help with the preparation and filing of tax returns.

Only dividends and realized gains will have tax due. A betterment is a specific type of project performed by a government entity that improves a specific area. Tax loss harvesting TLH works by using investment losses to.

If you have 100000 or more you can enjoy the services of certified financial planners CFP. Even with a Betterment Builder account which is an account with an investment balance of less than. Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals.

Ad Align your values and investments with Betterments upgraded SRI portfolios. With Betterment you can automatically import your tax information into TurboTax. Choose from Broad Impact Social Impact and Climate Impact portfolios.

Betterment increases after-tax returns by a combination of tax-advantaged strategies. If you have a personal. On top of that Betterment supports a much wider range of account types.

Tax-loss harvesting has been shown to boost after. They are not intended to provide comprehensive tax advice or. The soonest you can start importing is Feb.

Should you need help Betterment Digital customers can pay 199 for a 45-minute coaching session with a financial professional to optimize their investments. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust. Betterment also offers tax-loss harvesting while Fidelity doesnt.

The no-fee plan costs 0 in fees and requires 0 in a minimum balance. Choose from Broad Impact Social Impact and Climate Impact portfolios. Betterment is one of the larger robo-investor sites which offers investors an alternative to more traditional human financial advisers.

Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains. The company also offers tax-loss harvesting and a large variety of account types. Betterment tax forms do not include a FATCA box as we do not allow for foreign investments in Betterment accounts.

Betterment will send you. If you have wash sales it gets more complicated since those adjusted transactions have to be itemized on Form 8949 and the summary totals adjusted accordingly. Now lets say you earn an average 7 annually on your portfolio.

Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals. The foreign taxes populate with the download but you have to manually enter the foreign source income total. 31 is the deadline for Betterment to provide Form 1099-R which reports distributions conversions and rollovers except direct IRA to IRA transfers from.

Betterment Digital provides automated portfolio management and charges 025 annually. Its up to you to decide for yourself. Projects that qualify as improvements will depend on the taxing jurisdiction.

Ad Align your values and investments with Betterments upgraded SRI portfolios. This 25000 tax deduction could potentially translate into savings of say 7500 in income taxes. The tax forms that Betterment will send you will be completely dependent on the type of accounts that you hold with them.

They are not intended to provide comprehensive tax advice or. The three Betterment fee tiers are all based on the balance in an investors portfolio. They are not intended to provide comprehensive tax advice.

Any tax forms from Betterment that do not have a FATCA box can be. On the other hand Fidelity gives. Betterment Tax Forms.

Betterment Taxes Summary. Betterment provides automatic tax loss harvesting to all investors at no extra cost for Taxable accounts only. Just lump them together under a country.

Tax Smart Investing With Betterment

6 Tax Strategies That Will Have You Planning Ahead

Why Has Betterment Frozen Checking Account Applications Forbes Advisor

A Beginner Investors Guide To Vanguard And Betterment Two Quality Low Cost Investment Providers So You Can Deter Investing Money Finance Investing Investing

The Betterment Experiment Results Mr Money Mustache

Betterment Roth Ira Is It Good

Services Provided By A Title Company Title Insurance Title Property Tax

Betterment Acquires Wealthsimple S U S Investment Advisory Book Of Business

Retirement Advice Retirement Calculator Investing For Retirement

Your 2015 Tax Season Calendar Tax Season Season Calendar Tax Help

Betterment Review Smartasset Com

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

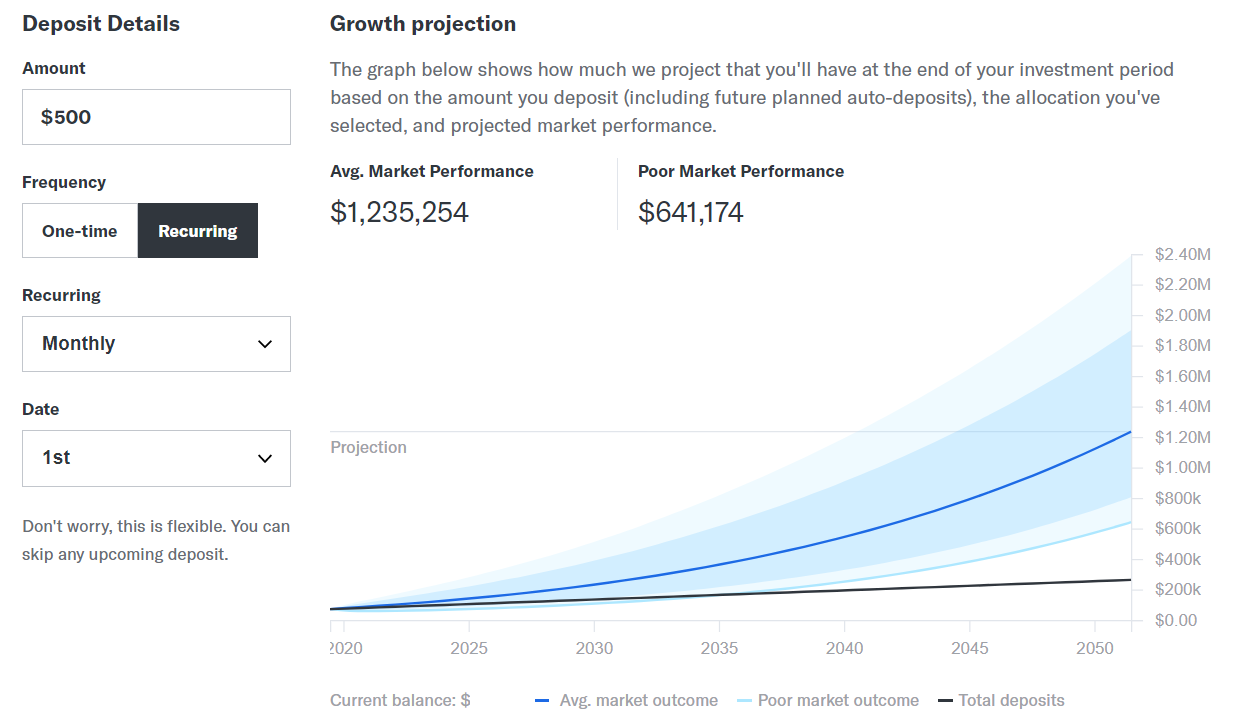

Betterment Review 2021 Is It Really A Smarter Way To Invest

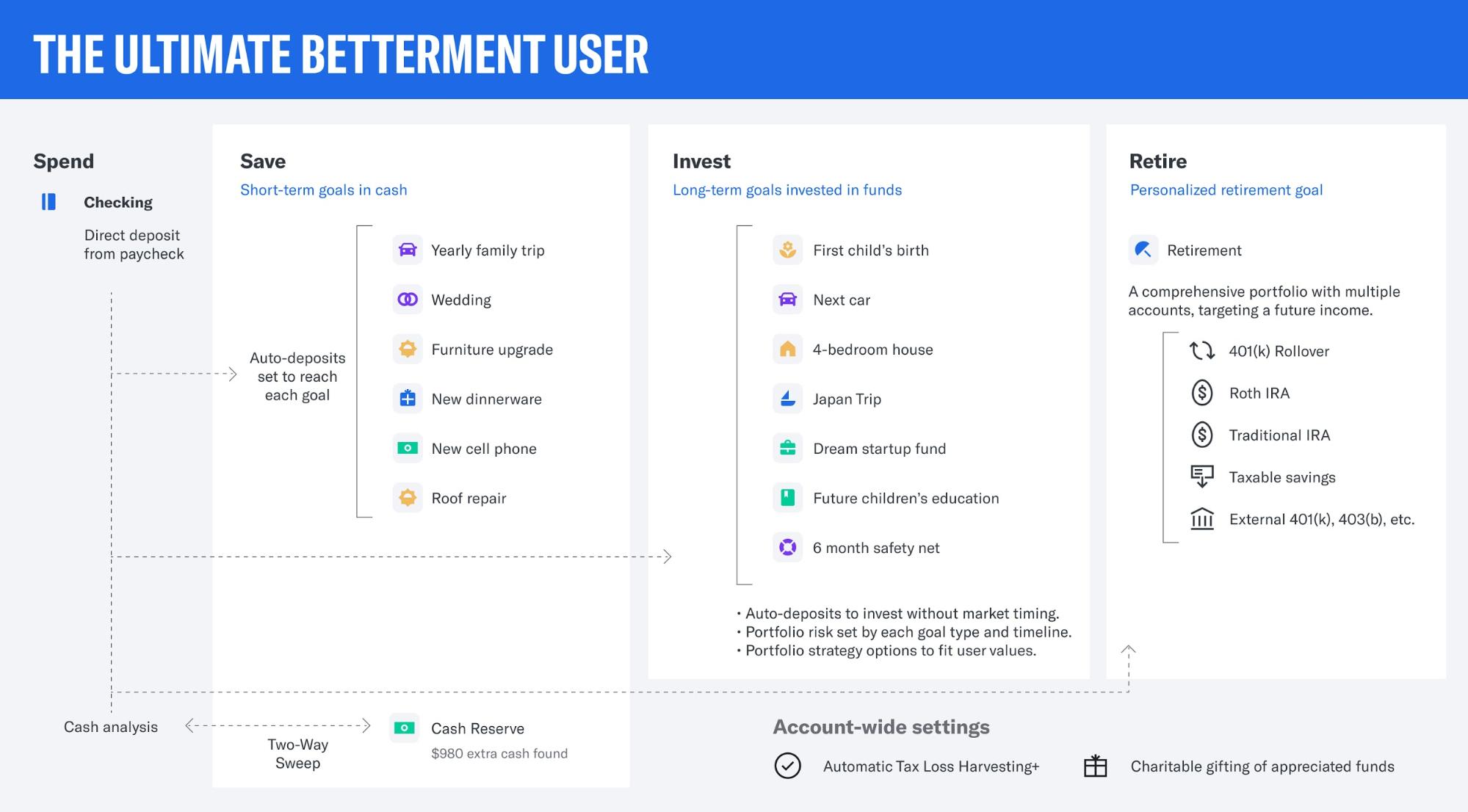

What The Ultimate Betterment User Looks Like

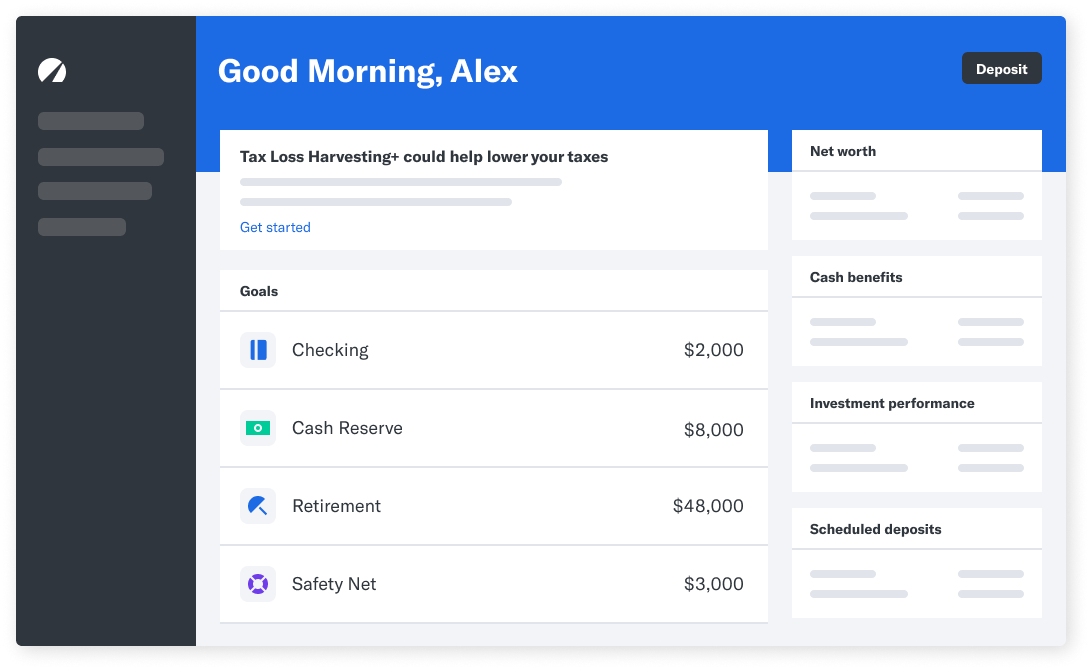

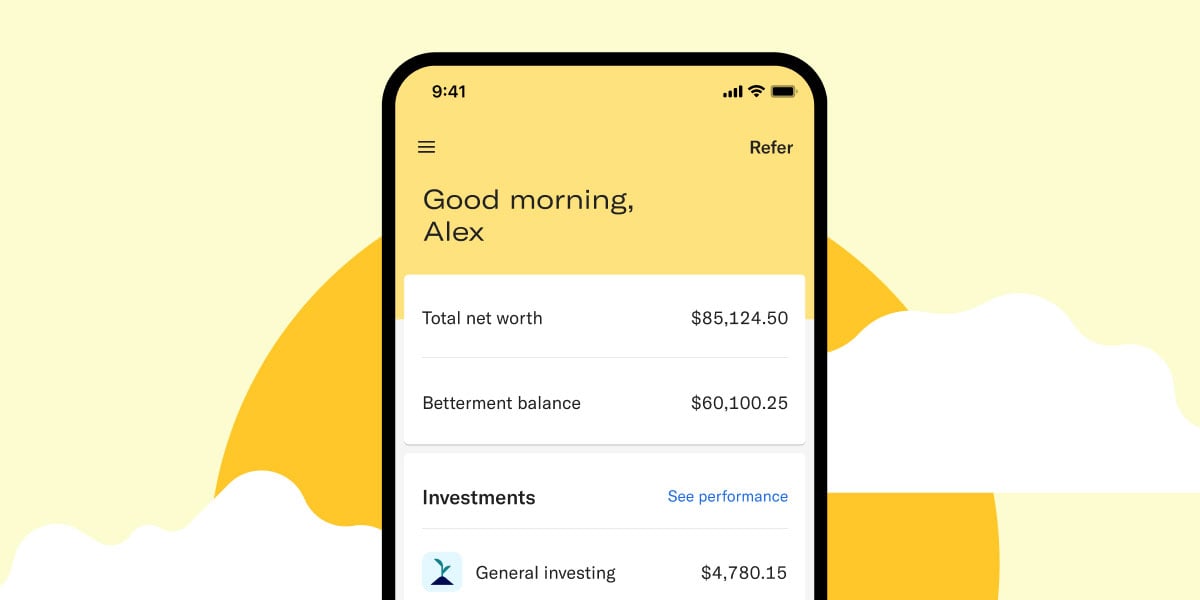

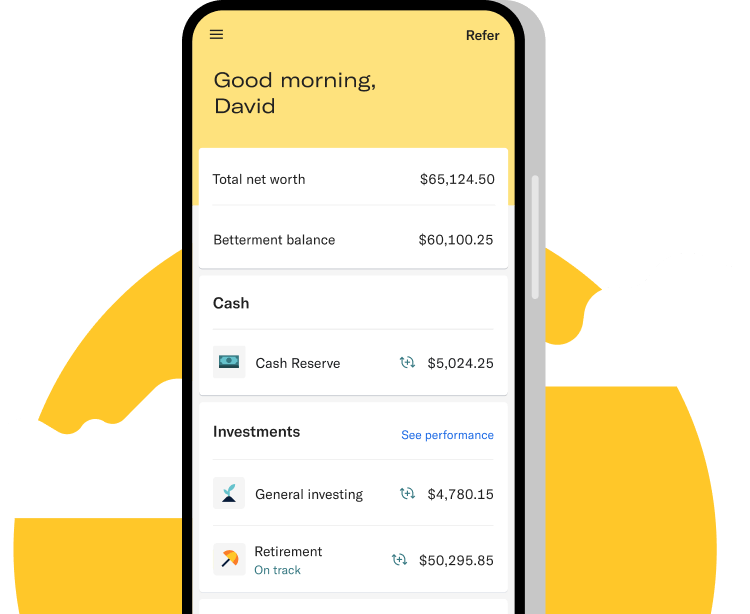

Betterment Mobile App Investing On The Go

Betterment Checking And Betterment Cash Reserve Review Cash Management Certificate Of Deposit Best Ira Accounts